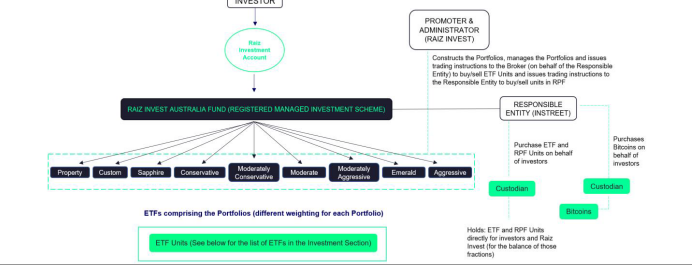

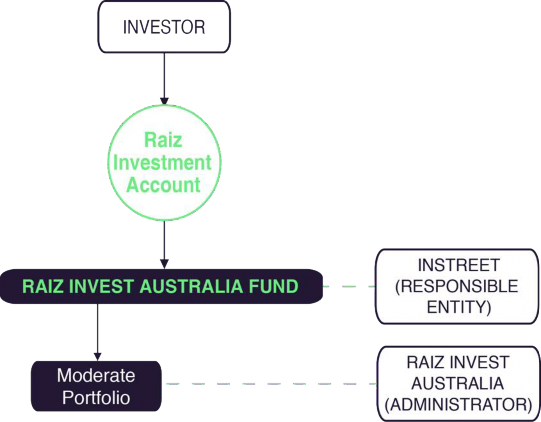

This Product Disclosure Statement (PDS) is issued by Instreet Investment Limited (ABN 44 128 813 016, AFSL 434776) (Instreet) to offer interests in the Raiz Invest Australia Fund, a registered managed investment scheme (ARSN 607 533 022) (Raiz or Fund).

About Instreet Investment Limited

Responsible Entity

Instreet is the Responsible Entity of the Fund. Instreet is 100% owned by Raiz Invest Limited and is responsible for the Fund's compliance with its constitution which establishes the Fund and sets out its rules (Constitution). The Constitution together with this PDS and the law governs Instreet's relationship with you. Key provisions of the Constitution include your right to direct us to invest your money in specified investments and to hold your investment on a separate trust for you (other than any fractional interests). If you would like to view a copy of the Constitution, please email us at constitution@raizinvest.com.au to make an appointment to view the Constitution in our office.

Client Enquiries: 1300 75 47 48

Email: support@raizinvest.com.au

Website: www.raizinvest.com.au

Promoter and Administrator

Address: Level 11, 2 Bulletin Place, Sydney NSW 2000 More information about Instreet (including financial

I. information) can be found at www.raizinvest.com.au

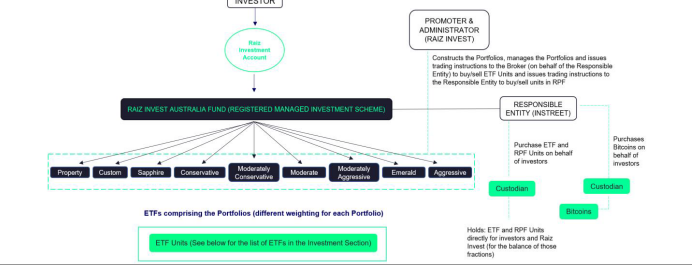

Raiz Invest Australia Limited (ABN 26 604 402 815) (Raiz Invest Australia or Promoter and Administrator) is 100% owned by Raiz Invest Limited. Instreet has appointed Raiz Invest Australia to manage the investments of the Fund. Raiz Invest Australia also provides administration, promotion, accountancy, distribution, scheme compliance, AML/CTF and regulatory services to the Fund. Instreet has appointed Raiz Invest Australia as an authorised representative of its Australian financial services licence. In this PDS, "we" and "us" means Instreet (in its capacity as Responsible Entity) and/or Raiz Invest Australia (in its capacity as Promoter and Administrator) as appropriate.

How the Raiz Invest Australia Fund works

Raiz is a micro-investing product that offers an easy way to regularly invest small or large amounts of money using the App on your mobile phone or the Website. The Fund is a registered managed investment scheme. If you apply to participate in Raiz, you apply to receive an interest in the Fund known as a Raiz Investment Account. The minimum investment amount is $5.00. You can make regular contributions to increase the value of your Raiz Investment Account, you can withdraw all or part of your investment, and your investments are held beneficially for you (subject to any fractional interests, which are pooled). If you apply, we establish one interest – one Raiz Investment Account – for each investor (Investor, or you).

Money in your Raiz Investment Account is invested into a Portfolio selected by you (Selected Portfolio). Some of the Portfolios access a mix of different exchange traded funds quoted on the ASX (ETFs) which are a pre-selected asset allocation for you. The Sapphire Portfolio has a mix of ETFs and Bitcoin. The Property Portfolio has a mix of ETFs and Raiz Property Fund (RPF). The Custom Portfolio allows you to choose the portfolio weights from a selection of ETFs, Bitcoin and RPF and create your own asset allocation. You choose the Portfolio best suited to your own goals and financial circumstances. The value of your Raiz Investment Account will vary as the market value of the ETFs, Bitcoin or RPF, comprising the Portfolio in which you have invested rises and falls.

There are two additional Portfolios (Property 10 and Property 30) offered by the Fund that have pre-selected asset allocations of ETFs and Raiz Residential Property Fund. These Portfolios are only available to customers of Raiz Invest Super, a superannuation product. Raiz Invest Super is issued by Equity Trustees Superannuation Limited (‘EQT’) (ABN 50 055 641 757, RSE Licence No. L0001458, AFSL 229757), an approved

Trustee regulated by the Australian Prudential Regulation Authority (APRA). Raiz Invest Super is administered in accordance with the Trust Deed and rules of AMG Super. For further details on these two Portfolios that are available only to Raiz Invest Super customers, refer to the PDS and Member Guide available here.

Contributing to and withdrawing from your Raiz Investment Account

There are three different ways you can make contributions to your Raiz Investment Account - you may make a lump sum deposit, activate Round-Ups or set up a recurring deposit.

You can request a withdrawal of all or part of your investment from your Raiz Investment Account through the mobile or web-based App. We will dispose of all or part of your Investments in your Raiz Investment Account once a Business Day and generally pay the withdrawal proceeds to you in cash within 5 Business Days. There are no fees or penalties for withdrawals. In some circumstances, including where there is a restriction on withdrawals, you may not be able to make a withdrawal from your Raiz Investment Account within the usual period upon request.

Distributions

Raiz does not pay distributions. Any distributions received by Raiz in respect of any underlying investments allocated to you will be automatically re-invested into your Raiz Investment Account. You can choose to withdraw the amount of any distribution that has been automatically re-invested into your Raiz Investment Account. There is no distribution in relation to Bitcoin.

Standing instruction to dispose of your portfolio holdings

From time to time, the Raiz App will make available to you the apps of other third-party providers. It is your choice whether to use these other apps. Unless we notify you otherwise, Raiz Invest Australia will not receive any fee for making these apps available to you. However, if you choose to use one of these apps, you may be giving us a standing instruction to dispose of enough ETF Units, RPF Units (or Bitcoin) in your Raiz Investment Account to cover any amount you owe to the third-party provider. Go to the Additional Information Document for further information at www.raizinvest.com.au/product-disclosure-statement#aid.

Benefits of investing in the Raiz Invest Australia Fund

The significant features of the Raiz Invest Australia Fund are:

Micro investing | Raiz is a micro-investing product designed to make investing and saving easy, and accessible to all. Raiz is offered through a mobile or web-based App. You can apply for a Raiz Investment Account with just $5.00. |

Investment Portfolios | You choose a Portfolio into which your Raiz Investment Account will be invested. The Portfolios have been constructed by a team of financial industry experts. Six Portfolios are comprised of ETFs only that are quoted on the ASX. The other portfolios comprise ETFs but can also include Bitcoin quoted on the Gemini Exchange or units in the Raiz Property Fund (RPF). |

Managed Investment Scheme | Your Raiz Investment Account is an interest in a registered managed investment scheme, being the Raiz Invest Australia Fund. |

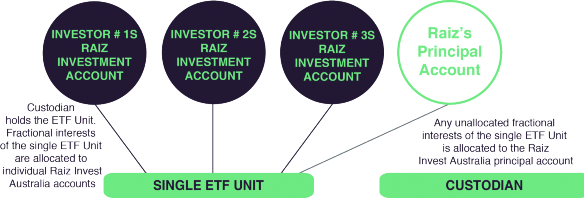

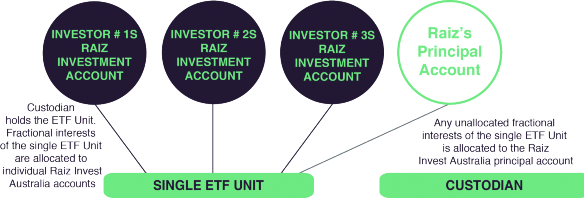

Fractional investing | One of the key features of Raiz is the ability to allocate fractional interests in ETF Units (or Bitcoin or RPF) to individual Investors. The Raiz system will facilitate the purchase of the relevant number of ETF Units (or Bitcoin or RPF) required across the Fund and allocate fractional interests in these ETF Units (or Bitcoin or RPF) to individual Investors, corresponding to the amount of funds they have invested in their Selected Portfolios. The whole ETF Units (or Bitcoin or RPF) themselves will be held in a pooled account with the Custodian (or Gemini Custodian) on behalf of all Investors who have been allocated a fractional interest in that ETF or RPF Unit (or Bitcoin). Fractional interests allow you to consistently invest funds as it becomes available, rather than having to wait until you have enough money to buy a complete ETF or RPF Unit (or Bitcoin). |

Withdraw at any time | You can request a withdrawal of all or part of your investment from your Raiz Investment Account through the mobile or web-based App. We will dispose of sufficient Investments in your Raiz Investment Account once a Business Day and generally pay the withdrawal proceeds in cash within 5 Business Days. There are no fees or penalties for withdrawals. Withdrawal requests will be subject to rounding and market risk. |

Raiz Kids | If you have children, grandchildren or other dependants, you can open up to 8 Raiz Kids Accounts – a Raiz Investment Account in the name of the child that only lets you invest and save until they reach 18 years old (without all the features of a normal Raiz Investment Account). Go to the Additional Information Document for more information at https://raizinvest.com.au/product-disclosure-statement/ |

No switching fee | Raiz does not charge switching fees if you change your Selected Portfolio (see Transaction Costs on page 6 for an explanation of applicable buy/sell spreads). |

No trading fees | Raiz does not charge fees for making contributions into or withdrawals from your Raiz Investment Account. Raiz also does not charge any brokerage, trading or transaction fees for purchasing the ETF or RPF Units (or Bitcoin). |

Regular savings | Raiz is based on the principle that regular investment, even if in small amounts, can lead to large savings over time. You can contribute to your Raiz Investment Account frequently (at no additional cost) by enabling Round-Ups, or by setting automatic recurring deposits. |

You should read the important information in the "Section 2 Other features and benefits" of the Additional Information Document about other features and benefits of the Fund before deciding to invest in the Fund. Go to the Additional Information Document at https://raizinvest.com.au/product-disclosure-statement/. The material relating to other features and benefits of the Fund may change between the time when you read this PDS and the day you acquire a Raiz Investment Account.

Risks of managed investment schemes

All investments carry risk. Different strategies may carry different levels of risk, and assets with the highest long-term returns may have the highest level of short-term risks. The significant risks of investing in the Raiz Invest Australia Fund are:

Performance risk | The value of your Raiz Investment Account can go up or down. Returns are not guaranteed, and you may lose money. The rate of return varies, so future returns may differ from past returns. Risk impacts vary for individual investors depending on age, investment time frame, other investments held and risk tolerance. |

Market risk | Changes in financial markets, residential property prices, the economy, political changes, technological developments, global or Australian-specific events and changes in market sentiment continually affect the value of investments in the Portfolios. For example, if you request a full cash withdrawal or close your Raiz Investment Account the amount you receive may be different (including less) from the last value displayed in your App or Website due to market movements. In addition, from time to time, the Fund or an ETF or Bitcoin or RPF may become illiquid or suspended from trading or quoting, in which case we cannot invest any new Contributions or fulfil a withdrawal request until the suspension ends. |

Interest rate risk | Changes in interest rates can directly and indirectly affect investment value or returns. For example, an increase in official interest rates can result in a fall in the value of fixed interest securities. |

Fund risk | The Fund could terminate, fees and expenses could increase, the Responsible Entity or any service provider may change. There is no guarantee that the investment strategy of the Fund will be managed successfully. Investment in the Fund is governed by the laws affecting managed investment schemes, the Constitution and this PDS, each of which may be amended from time to time. |

Portfolio performance risk | The performance of your Raiz Investment Account may vary from the performance of another Raiz Investment Account which invests in the same Selected Portfolio. This is because contributions will be invested in the Selected Portfolio over time and for differing amounts, and the rebalancing algorithm may lead to different weightings between Portfolios, differences in costs due to the buy/sell spreads incurred when selling ETFs (or Bitcoin or selling/buying residential property for the RPF) to pay fees. |

ETF performance risk | Some of the underlying ETFs may not achieve their investment objective. This may mean that the return that is generated for a particular Portfolio may differ from the stated investment objective of that Portfolio. |

Bitcoin risk | This risk only applies to the Sapphire Portfolio and the Custom Portfolio (if you choose to include Bitcoin). Bitcoin carries a lot of risk, not just market risk, with the possibility that sometime in the future Bitcoin may have no value. This risk may render it unsuitable for most investors. The historic volatility of Bitcoin is 86% p.a. This means 1 out of every 3 years you would expect Bitcoin to move plus or minus 86% p.a. in a year. It also means that 1 out of every 20 days you can expect Bitcoin to move more than plus or minus 10.8% in a day. Bitcoin does not have a performance objective like an ETF; the performance objective relates to the Sapphire Portfolio. If the price of Bitcoin is falling, the rebalance algorithm will keep buying Bitcoin to maintain a target asset allocation percentage, thereby increasing possible losses. There is also a cyber security risk that the Gemini Exchange may be “hacked”. Raiz will aim to keep at least 95% of its Bitcoin holding in highly secure Cold Storage with Gemini Custodian, unconnected to the internet and up to 5% of the holding on the Gemini Exchange. There is also the risk that Gemini may not be able to meet their obligations as an exchange and/or a custodian. See Section 3. Other risks in the AID for a more detailed description. |

RPF risk

Concentration risk | RPF may hold Australian residential property directly, or indirectly through the Raiz Residential Property Fund. Property valuations may fluctuate due to residential property prices and real property assets tend to be illiquid. You should read the important information both in the Additional Information Document (see below) and in the PDS for the Raiz Property Fund, which is incorporated by reference into this PDS. The RPF may not achieve the investment objectives set out in the RPF PDS. This may mean the return generated may not be in line with the performance of residential property in Australia. The Fund will be subject to some degree of concentration risk, the risk that an ETF issuer fails or does not perform. Raiz invests in ETFs provided by 7 issuers. |

No guarantee | None of Instreet Investment Limited, Raiz Invest Limited and Raiz Invest Australia Limited and, their related entities, officers or personnel, or the issuers of any Investments guarantee the performance of your Raiz Investment Account or the repayment of any amount invested or any rate of return. No one makes any representation as to the success or otherwise of your Raiz Investment Account. |

Data security & electronic delivery risk | Because your Raiz Investment Account is a fully online financial product, which relies on computers, information technology (IT) networks and the internet, it is subject to inherent IT risks including (but not limited to) software bugs, computer viruses and malware, unauthorised interference with data, loss of data, unavailability or unreliability of the internet, computer malfunction, and cyber hacking resulting in the theft of data. Raiz may be unavailable from time to time. Your data is stored on secured servers in Australia. You will need to consider the potential for disruption or other difficulties when planning to use your Raiz Investment Account and the Website. |

These significant risks apply to all the Portfolios, except Bitcoin Risk which applies only to the Sapphire Portfolio and may apply to the Custom Portfolio and RPF risk which apply only to the Property and may apply to the Custom Portfolio. The different impact these risks have on the Portfolio is explained in the AID (available at www.raizinvest.com.au/product-disclosure-statement#aid).

You should read the important information in the "Section 3 Other risks" of the Additional Information Document about other risks of investing in managed investment schemes before deciding to invest. Go to the Additional Information Document at www.raizinvest.com.au/product-

disclosure-statement#aid. The Additional Information Document is incorporated by reference, and forms part of, this PDS. The material relating to other risks of managed investment schemes may change between the time when you read this PDS and the day you acquire a Raiz Investment Account.

How we invest your money

Money in your Raiz Investment Account is invested into your Selected Portfolio only once a Business Day. There are nine separate Portfolios to choose from, including different ETFs, in the Sapphire Portfolio, 5% Bitcoin and in the Property Portfolio, 30% in RPF units. The Custom Portfolio allows you to choose your own mix, including RPF and up to 5% Bitcoin. Warning: you should consider the likely investment return, risk and your investment timeframe when choosing a portfolio suitable for you to invest in.

The Portfolios and underlying investments are set out in detail in the AID. They include: Australian large and small cap stocks; Asian large cap stocks; European large cap stocks; US large cap stocks; Australian and Global ethically conscious and sustainable stocks and fixed income; Australian and Global money market and/or fixed income; and Emerging Market stocks. They also include sector or theme ETFs with exposures to themes such as US technology stocks; Global cybersecurity stocks, Global infrastructure stock, gold, Global healthcare stocks and more. As well as Bitcoin and the Raiz Property Fund.

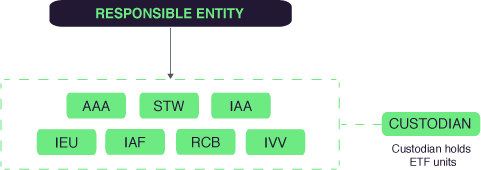

Moderately Aggressive Portfolio

This portfolio has a moderately high portfolio weighting to Australian and international equities and may suit an investor who is prepared to take more risk in exchange for potentially higher returns over the medium to long term, and is comfortable with volatility and the possibility of negative returns. The investment objective of the Moderately Aggressive Portfolio is to provide a moderate to high level of risk which corresponds to moderate to high expected returns with capital appreciation over the long term. The minimum suggested investment timeframe for this portfolio is 3-5 years. This portfolio is considered to be moderate to high risk. The assets in which the Moderately Aggressive Portfolio invests, and the strategic target allocation of asset classes, is as follows:

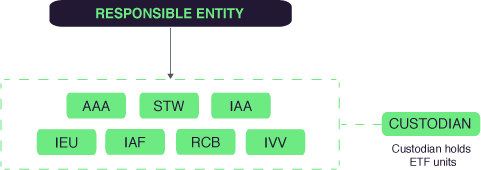

Asset Class | ETF | Target asset allocation |

Australian large cap stocks | SPDR S&P/ASX 200 ETF (STW.AU) | 43.60% |

Asian large cap stocks | iShares ASIA 50 ETF (IAA.AU) | 13.80% |

European large cap stocks | iShares Europe ETF (IEU.AU) | 6.40% |

US large cap stocks | iShares Core S&P 500 ETF (IVV.AU) | 8.90% |

Australian government bonds | iShares Core Composite Bond ETF (IAF.AU) | 3.00% |

Australian corporate bonds | Russell Australian Select Corporate Bond ETF (RCB.AU) | 21.30% |

Australian money market | BetaShares Australian High Interest Cash ETF (AAA.AU) | 3.00% |

You should read the important information in the "Section 4 Investments" of the Additional Information Document about the other Portfolios, ETFs, RPF and Bitcoin; the risks associated with the Portfolios; switching Portfolios; how the Portfolios may be changed; and the extent to which labour standards or environmental, social or ethical considerations are taken into account in the investment activity relating to the product, before deciding to invest in the Fund. Go to the Additional Information Document at www.raizinvest.com.au/product-disclosure- statement#aid. The material relating to this information may change between the time when you read this PDS and the day you acquire a Raiz Investment Account.

Fees and costs

DID YOU KNOW?

Small differences in both investment performance and fees and costs can have a substantial impact on your long term returns.

For example, total annual fees and costs of 2% of your account balance rather than 1% could reduce your final return by up to 20% over a 30 year period (for example, reduces it from $100 000 to $80 000).

You should consider whether features such as superior investment performance or the provision of better member services justify higher fees and costs.

You may be able to negotiate to pay lower contribution fees and management costs where applicable. Ask the Fund or your financial adviser.

TO FIND OUT MORE

If you would like to find out more, or see the impact of the fees based on your own circumstances, the Australian Securities and Investments Commission (ASIC) website (www.moneysmart.gov.au) has a managed investment fee calculator to help you check out different fee options.

This document shows fees and other costs that you may be charged. These fees and costs may be deducted from your money, from the returns on your investment or from your Raiz Investment Account as a whole. Taxes are set out in another part of this document. You should read all the information about fees and costs because it is important to understand their impact on your investment. We may from time to time, in our absolute discretion, waive one or more fees for all investors for a period of time as we determine.

| All Portfolios except Sapphire & Property Portfolios | Sapphire Portfolio & Property Portfolio Fees |

Type of fee or cost | Amount1 | How and when paid |

Ongoing annual fees and costs |

Management fees and costs2 The fees and costs for managing your investment | Standard Portfolio $0.00 p.a. (account balance of less than $15,000) | 0.275% p.a. for all account balances. | The Management fees and costs of the Fund consist of the following components:

Account Fee: Calculated and accrues daily on your Raiz Investment Account balance. Paid monthly in arrears directly out of your Raiz investment Account. Assets in your Account (ie ETFs, RPF or Bitcoin) will be sold to pay this Fee.

The fees and costs charged by Raiz relate only to gaining access to the underlying Portfolio investments through the Raiz Investment Account (part of the Raiz Invest Australia Fund). These fees and costs do not include the fees and costs that relate to investing in the underlying accessible financial products (being the ETFs and investments in the Portfolios). |

Account Fees | or |

|

| 0.275% p.a. (account balance equal to or greater than $15,000) |

|

| Custom Portfolio |

|

| $0.00 p.a. (account balance of less than $20,000) |

|

| or |

|

| 0.275% p.a. (account balance equal to or greater than $20,000) |

|

| Raiz Kids |

|

| An additional fee of: |

|

| $0.00 p.a. (combined Raiz Kids account balance of less than $8,750); or |

|

| 0.275% p.a. (combined Raiz Kids account balance equal to or greater than $8,750) |

|

Performance fees Amounts deducted from your investment in relation to the performance of the product |

Nil |

Nil |

Not applicable |

Transaction costs The costs incurred by the scheme when buying or selling assets3 | Nil – other than buy-sell spread below | Nil – other than buy-sell spread below | Not applicable – other than buy-sell spread below |

Member activity related fees and costs (fees for services or when your money moves in or out of the product)3 |

Establishment fee The fee to open your investment |

Nil |

Nil |

Not applicable |

1All fees are expressed as a percentage of gross asset value of your Raiz Investment Account excluding accrued fees.

2 Management fees and costs reduce the balance of your Raiz Investment Account. For all Portfolios except Sapphire Portfolios, if your Raiz Investment Account balance is less than $15,000 or $20,000 for custom portfolio, you will be charged a Maintenance Fee directly from your Funding Account. The Maintenance Fee does not reduce the balance of your Raiz Investment Account. Please refer to "Additional explanation of fees and costs" below for more information.

3 Please refer to "Additional explanation of fees and costs" below for information on additional services fees which may be charged by the Fund.

| All Portfolios except Sapphire & Property Portfolios | Sapphire Portfolio & Property Portfolio Fees |

Type of fee or cost | Amount1 | How and when paid |

Ongoing annual fees and costs |

Contribution fee The fee on each amount contributed to your investment | Nil | Nil | Not applicable |

Buy-sell spread An amount deducted from your investment representing costs incurred in transactions by the scheme | Capped at 0.25% to mid point of the last market bid/offer. | Capped at 0.25% to mid point of the last market bid/offer. | Where the acquisition or disposal of ETFs, RPF or Bitcoin on behalf of Investors does not require a transaction on-market (due to the netting of transactions), we may apply a buy/sell spread (called a Netting Spread in the PDS). The Netting Spread is determined with reference to the mid-point of the last market bid/offer spread for the ETF Units (or RPF or Bitcoin) and is equal to or less than the smaller of the market bid/offer spread or 0.50%. |

Withdrawal fee The fee on each amount you take out of your investment |

Nil |

Nil |

Not applicable |

Exit fee The fee to close your investment |

Nil |

Nil |

Not applicable |

Switching fee The fee for changing investment options |

Nil |

Nil |

Not applicable |

#There are no commissions paid to financial advisers in respect of the Fund. Additional fees may be paid to a financial adviser if an investor consults one. Where an investor receives financial advice, investors should refer to their Statement of Advice or their adviser’s Financial Services Guide for full details of these fees.

Please refer to “Additional explanation of fees and costs” set out in the Additional Information Document for additional services fees which may be charged by the Fund.

Example of annual fees and costs for this fund

This table gives an example of how the fees and costs for this managed investment product can affect your investment over a 1-year period. You should use this table to compare this product with other managed investment products. All amounts are inclusive of GST.

Example – Raiz Investment Account (Conservative Portfolio) | Balance of $50,000 with total contributions of $5,000 at the beginning of the year |

Contribution Fees | Nil | For every additional $5,000 you put in, you will be charged $0 |

PLUS Management fees and costs | 0.275% p.a. (for accounts with $15,000 or more)* | And, for every $50,000 you have in the Fund’s Conservative Portfolio, you will be charged or have deducted from your investment $137.50 each year. If you contribute a further $5,000 at the beginning of the year, you will be charged or have deducted from your investment a further $13.75 each year. |

PLUS Performance fees | N/A | N/A |

PLUS Transaction costs | Nil | And, you will be charged or have deducted from your investment $0 in Transaction Costs**. |

PLUS Maintenance Fees | $0 per month (for accounts with $15,000 or more)*** | And, you will be charged or have deducted from your Funding Account $0 in Maintenance Fees. |

PLUS Underlying Issuer Fees | 0.190% p.a. | And, for every $50,000 you have, you will be charged or have deducted from your investment $94.83 in Underlying Issuer Fees. |

|

|

If you contribute a further $5,000 at the beginning of the year, you will be charged or have deducted from your investment a further $9.48 each year in Underlying Issuer Fees. |

PLUS Underlying Issuer Transaction & Operational Costs | 0.04% p.a. | And, you can be charged or have deducted from your investment $22 in Underlying Issuer Transaction & Operational Costs. |

EQUALS Cost of the Conservative Portfolio | 0.505% p.a. | If you had an investment of $50,000 at the beginning of the year and you put in an additional $5,000 at the beginning of that year, you would be charged fees and costs of $277.56

What it costs you will depend on the fees you negotiate. |

* Management fees and costs for the Conservative Portfolio are nil for accounts with less than $15,000. However, in such circumstances you will be charged the Maintenance Fee. See description of Maintenance Fee that follows.

** Please refer to “Additional explanation of fees and costs” in the Additional Information Document for information on the Netting Spread, which may be applicable when acquiring or disposing of investments.

*** Maintenance Fees for the Conservative Portfolio are $3.50 per month (being $42 per year) for accounts with less than $15,000.

The fees and costs charged by Raiz relate to the use of the Raiz app and access to the underlying ETFs, RPF and Bitcoin (the accessible financial products) only, and do not include the fees and costs that relate to investing in the accessible financial products (noting there are no Underlying Issuer Fees or Underlying Issuer Transaction & Operational Costs for investing in Bitcoin). You should be aware that additional fees and costs will be charged by the issuers of the accessible financial products that the investor decides to invest in. To help you understand how the fees and costs of the accessible financial products will affect you, we have included these fees in our examples of the Fund’s fees and costs. Fees can change, subject to the maximum specified in the Constitution. We will generally provide at least 30 days’ notice of any proposed changes. Additional and extraordinary expense recoveries can vary without notice and there is no limit on these.

Maintenance Fee

Standard Portfolio: A monthly Maintenance Fee of $3.50 is payable for six of the standard portfolios if your Raiz Investment Account has a value of less than the $15,000 threshold at the end of each month. If your balance is equal to or greater than $15,000, there is no Maintenance Fee.

Sapphire Portfolio: The monthly Maintenance Fee is $3.50 for the Sapphire Portfolio (irrespective of your Account balance).

Property Portfolio: The monthly Maintenance Fee is $4.50 for the Property Portfolio (irrespective of your Account balance).

Custom Portfolio: The monthly Maintenance Fee of $4.50 is payable for the Custom portfolio if your Raiz Investment Account has a value of less than $20,000 at the end of each month. If your Account has a value of equal to or greater than $20,000, there is no Maintenance Fee.

Raiz Kids: An additional monthly Maintenance Fee of $2.00 is payable for using Raiz Kids if the combined balances of the Raiz Kids accounts have a value of less than $8,750 at the end of each month, irrespective of whether you’ve set up 1 Raiz Kid Account or 8. If the combined balances of the Raiz Kids accounts has a value of equal to or greater than $8,750, there is no additional Maintenance Fee.

In-Specie Transfer Fees

If you request an in-specie transfer of your ETFs you will incur a charge per ETF being transferred. The charge is the greater of $50 or 0.25% of the value of the relevant ETF being transferred. It is calculated on the basis of each relevant ETF being transferred, not on the value of your Raiz Account. Please be aware that if the in-specie transfer of an ETF to a HIN, the details of that HIN must be identical to the details of your Raiz Investment Account. Please note that it is not possible to request an in-specie transfer of RPF Units and/or Bitcoin and any Redemption Request requesting these will be rejected by the Responsible Entity.

You must read the important information in the “5. Fees and costs” section of the Additional Information Document about fees and costs before deciding to invest. Go to the Additional Information Document at www.raizinvest.com.au/product-disclosure-statement#aid . The material relating to fees and costs may change between the time when you read this PDS and the day you acquire a Raiz Investment Account.

How managed investment schemes are taxed

Warning: Investing in a managed investment scheme is likely to have tax consequences. Consumers are strongly advised to seek professional tax advice. Registered managed investment schemes (such as the Fund) do not pay tax on behalf of their members. Members are assessed for tax on any income and capital gains generated by the registered managed investment scheme.

You must read the important information in the “Section 6 Taxation” of the Additional Information Document about taxation before deciding to invest. Go to the Additional Information Document at www.raizinvest.com.au/product-disclosure-statement#aid . The material relating to taxation may change between the time when you read this PDS and the day you acquire a Raiz Investment Account.

How to apply

To apply for a Raiz Investment Account, you must: read and carefully consider this PDS, AID and TMD (and, if relevant, the RPF PDS and TMD, and the PDSs in respect of each underlying ETF); complete and submit a valid application through either the Raiz App or the Website; be

a resident of Australia; and be at least 18 years old at the time you submit your Application; and make an initial contribution of at least $5.00. Trustees of Self-Managed Super Funds (SMSF) may also apply for a Raiz Investment Account.

We will not establish your Raiz Investment Account, and you will have no interest in the Fund, until we have received your first contribution of at least $5.00. We will send you an email confirmation once we have established your Raiz Investment Account. We are required by law to obtain, verify, and record information that identifies each person or beneficiary who applies for a Raiz Investment Account. This process may be automated through the App and Website, but you may be required to provide additional information, in certain circumstances.

Cooling-off rights

If you change your mind about investing in an Raiz Investment Account, you can ask us to cancel your Raiz Investment Account (or "cool-off") but there’s a limited time to do this—within 14 days of the earlier of when you receive your email notification confirming the establishment of your Raiz Investment Account, or 5 Business Days after we establish your Raiz Investment Account. If you "cool-off" we will (if we reasonably can) realise any Investments we have made for you and pay to you the proceeds together with any other money we hold for you (less any transaction costs and any other expenses we have incurred in respect of your Raiz Investment Account) but we will not do so if we determine that it would not be fair to all Investors to do so.

Complaints

If you have any enquiries about the Fund or your Raiz Investment Account please visit our Website or your mobile phone App. If you have a complaint about the Fund or your Raiz Investment Account please contact us by email at complaints@raizinvest.com.au or by phone on 1300 754 748 or in writing to us at Level 11, 2 Bulletin Place, Sydney NSW 2000. We will confirm receipt of any complaint by email and get back to you when we have investigated the circumstances. If you are not satisfied with our response or our handling of your complaint, you can seek assistance from the Australian Financial Complaints Authority. AFCA provides fair and independent financial services complaint resolution that is free to consumers.

Australian Financial Complaints Authority Phone: 1800 931 678

Email: info@afca.org.au

Website: www.afca.org.au

You should read the important information in the "Section 7 Complaints" of the Additional Information Document about complaints before deciding to invest in the Fund. Go to the Additional Information Document at www.raizinvest.com.au/product-disclosure-statement#aid. The material relating to complaints may change between the time when you read this statement and the day you acquire a Raiz Investment Account.

Other information

Raiz Invest Australia Limited and Raiz Invest Limited have given and not withdrawn their consent to the statements about them included in this PDS in the form and context in which they appear.

Perpetual Corporate Trust has given and not withdrawn its consent to be named in this PDS as custodian of the Fund in the form and context in which it is named. Perpetual Corporate Trust does not make, or purport to make, any statement that is included in this PDS and there is no statement in this PDS which is based on any statement by Perpetual Corporate Trust. To the maximum extent permitted by law, Perpetual Corporate Trust expressly disclaims and takes no responsibility for any part of this PDS other than the references to its name. Perpetual Corporate Trust does not guarantee the repayment of capital or any particular rate of capital or income return.

Gemini Trust Company, LLC (Gemini) has given and not withdrawn its consent to be named in this PDS as custodian of the Fund in the form and context in which it is named. Gemini does not make, or purport to make, any statement that is included in this PDS and there is no statement in this PDS which is based on any statement by Gemini. To the maximum extent permitted by law, Gemini expressly disclaims and takes no responsibility for any part of this PDS other than the references to its name. Gemini does not guarantee the repayment of capital or any particular rate of capital or income return.

Consents for additional service providers as required are shown in various PDS and AIDs in relation to that investment option.

Investing in your Raiz Investment Account

Raiz is a micro investing product that offers an easy way to regularly invest either small or large amounts of money using the App from your mobile phone or the Website. Raiz is a registered managed investment scheme. If you apply to participate in Raiz, you apply to receive an interest in the Raiz Invest Australia Fund, which is a registered managed investment scheme (ARSN 607 533 022). We call this interest a “Raiz Investment Account” because you can make regular contributions to increase its value, you can withdraw all or part of your investment anytime you wish, and the ETFs (or Bitcoin or RPF Units) you choose to invest in are held beneficially for you (subject to any fractional interests, which are pooled). If you apply, we establish one interest – one Raiz Investment Account – for each investor (Investor, or you).

For eight portfolios Raiz specifies target allocations to each of the ETFs (or RPF or Bitcoin) to give each Portfolio the required exposure to equity and fixed-income assets (Target Allocations) (please refer to “Portfolios” below for more information on the Target Allocations). There is a ninth portfolio option that allows you to choose the specific target allocation for each ETFs, or RPF Units or Bitcoin for your portfolio. This is the Custom Portfolio option. There is a selection of ETFs and Bitcoin and RPF Units, please refer to the “Investment” section below for more information. RPF Units refers to units in the Raiz Property Fund (RPF), a Raiz managed investment scheme which provides you with exposure to Australian residential property.

To invest in a Raiz Investment Account, you must agree to rebalance your Raiz Investment Account automatically and to re- invest all distributions automatically (there are currently no distributions in relation to Bitcoin). The Raiz algorithm is designed to keep the allocation of your Raiz Investment Account within the range specified for your Selected Portfolio, even when the market prices of the ETFs, RPF Units or Bitcoin fluctuate. As you invest or withdraw money, Raiz will initiate corresponding transactions to rebalance your Raiz Investment Account to maintain your Selected Portfolio with no brokerage fees. If you change your Selected Portfolio, or select a new Target Allocation in your Custom Portfolio, Raiz will rebalance your Raiz Investment Account so that it reflects your new Selected Portfolio, with no switching fee.

Each Raiz Investment Account is structured as a separate trust account (bare trust). This means that each Investor has a direct, beneficial interest in the Investments held within their Raiz Investment Account. The legal title to the Investments will be held by the Custodian.

Warning: If you invest through a Raiz Investment Account, the Custodian is the legal owner of your Investments and your rights in relation to your Investments differ from those of direct investors. You will not have rights to attend meetings of holders of your Investments, you will not have rights to make elections in relation to corporate actions for your Investments, and you may have limited cooling off rights. |

Connecting to your Funding Account | To invest in a Raiz Investment Account you must connect your Raiz Investment Account to your Funding Account using the App. All transactions (including contributions and withdrawals) must be made through your Funding Account, by direct debit and you will have authorised Raiz to direct debit your account. See the Direct Debit Request Service Agreement, in the Terms and Conditions of using the Raiz App www.raizinvest.com.au/terms/. Your Funding Account cannot be a credit card, overdraft amount or any other borrowed money. |

Contributions | There are 3 different ways you can make contributions to your Raiz Investment Account. There are no fees or charges for making contributions. |

Lump Sum Deposit | You may add money to your Raiz Investment Account from your Funding Account by entering the desired amount on the Deposit/Withdraw screen of the App. |

Round Ups | You may choose to link your Spending Accounts (bank account, credit card or debit card) and then round up the virtual change from every transaction. These round-up contributions (Round- Ups) can be transferred into your Raiz Investment Account manually or automatically. You can view your Round-Ups on the Round-Ups screen of the App. Automatic Round-Ups can be turned on and off under the Accounts section of the Settings screen. When enabled, the virtual spare change that has been rounded-up from your transactions is automatically invested for you each time the sum of pending Round-Ups associated with your Spending Account reaches $5 or more as displayed in the App. The App will initiate a Round-Up investment by direct deposit from your Funding Account. When automatic Round-Ups are not enabled, you can still specifically authorise the App to initiate a deposit from your Funding Account, corresponding to Round-Ups that you have selected. |

Recurring Deposits | You may set up recurring deposits from your Funding Account on a daily, weekly, or monthly basis. Recurring Deposits can be turned on and off under the Accounts section of the Settings screen. You can select the amount of money you wish to invest regularly, and then choose the desired frequency. This is done under the “Recurring” tab of the Deposit/Withdraw screen. A Savings Goal is a recurring deposit with a date that the recurring deposit will stop. |

Reinvestment of income | We calculate income (if any) received for your Raiz Investment Account daily. Your income will be automatically reinvested in your Raiz Investment Account within 2 Business Days of calculation. Even though any income on your Raiz Investment Account is automatically reinvested, it still may be income to you for tax purposes. If you would prefer to receive your distributions as income, you can choose to simply withdraw the amount of any distribution that has been automatically re-invested into your Raiz Investment Account. |

Franking credits | At the end of each financial year, we will notify you of any franking credits which you are entitled to in respect of the ETFs in your Raiz Investment Account. As there are no distributions paid in relation to Bitcoin you will not be entitled to any franking credit in respect of any Bitcoin in your Raiz Investment Account. |

Accessing your money | Withdrawals can be made for cash or as in-specie, subject to the conditions outlined below. Cash Withdrawals You can request a cash withdrawal from your Raiz Investment Account at any time. We will dispose of sufficient Investments in your Raiz Investment Account only once a Business Day and generally pay the withdrawal proceeds as cash within five Business Days of disposal of your Investments. There are no fees or penalties for cash withdrawals.

If you request a full cash withdrawal or close your Raiz Investment Account, the amount you receive will be different (including less) from the last value displayed in your App due to market movements and operational requirements.

Raiz is not an online trading or stock broking platform and should not be used as a substitute to a stock-broker.

In-Specie Withdrawals You can request an in-specie withdrawal of assets from your Raiz Investment Account (other than in relation to RPF Units and Bitcoin) upon prior agreement with the Responsible Entity. An "in-specie withdrawal" from your Raiz Investment Account is the process of transferring the ETF Units in your Portfolio directly to you. In-specie withdrawals may be conducted via HIN transfer, (either to your nominated broker account or to the ETF Issuer-sponsored sub-register) and will incur In-specie Transfer Fees per ETF unit. Please see Fees and Costs section below. You will also be required to provide verification information again. In-specie withdrawals will only be satisfied with respect to whole numbers of ETF Units only, and not with respect to any fractional interests in ETF Units allocated to a Raiz Investment Account. Please note that we cannot do an in-specie withdrawal of RPF Units or Bitcoin. All RPF Units and Bitcoin have to be redeemed for cash. |

| Acceptance of withdrawal requests We will accept your withdrawal request when you make it, unless: If any of these events occur, we can delay accepting your withdrawal request until the relevant circumstances change, or you elect cash withdrawal of your RPF Units or Bitcoin. We will notify you by email of any delay and will not be liable for any loss you may suffer because of a delay. If, at any time, the Raiz Invest Australia Fund is not liquid (as defined by law), you will not be able to withdraw except on the terms of any withdrawal offer we make as permitted by law. We may not be obliged to make such offers.

Rounding of withdrawal requests If you submit a withdrawal request that, if accepted, would result in your Raiz Investment Account balance falling to an amount that is less than:

then such withdrawal request will, if accepted, be rounded up such that all Investments in your Raiz Investment Account will be sold, the proceeds of the Sale paid to you, and your Raiz Investment Account balance will be zero.

Note The Raiz Property Fund is a liquid fund. Under the RPF Constitution, the responsible entity of the RPF has up to 180 days to redeem RPF Units the subject of a redemption request. The responsible entity expects to be able to redeem RPF Units daily, but depending on market conditions and certain circumstances, there may be a delay which could impact the ability to access your money in your Raiz Investment Account. |

Distributions | All distributions received by Raiz in respect of an ETF or RPF Unit (or fraction of an ETF or RPF Unit) that you have been allocated will be automatically re-invested into your Raiz Investment Account. If you do not hold a Raiz Investment Account (because, for example, you have closed it) at the time an ETF or RPF distribution is received by the Fund, you will not receive that distribution and it will instead be donated to charity.

If you would prefer to receive your distributions as income, you can choose to simply withdraw the amount of any distribution that has been automatically re-invested into your Raiz Investment Account. It is free to make a withdrawal from your Raiz Investment Account and withdrawals can be made at any time.

Bitcoin pays no distribution. |

there is a restriction on us or your Investments that prevents us from disposing of sufficient Investments;

the disposal of an Investment is delayed by circumstances outside our control (for example, a disruption in the financial markets on which the ETF Units are quoted or illiquidity in the Raiz Property Fund);

you have requested an in-specie withdrawal of RPF Units or Bitcoin.

$5; or

5% of its current balance (where your current balance is less than $500 at the time of the withdrawal request),

Structure of the Fund

Other features and benefits

Reinvestment of distributions |

All distributions received by Raiz in respect of an ETF or RPF Unit (or fraction of an ETF or RPF Unit) that you have been allocated will be automatically re-invested into your Raiz Investment Account. There is no distribution in relation to Bitcoin. |

Netting of transactions |

Raiz can avoid charging brokerage fees to Investors, by eliminating unnecessary market transactions by relying on a process known as netting. This process works to offset buy and sell transactions between individual Raiz Investment Accounts, so that only the net position is traded on market only once on a Business Day. (See Netting Policy in Section 4). |

Maintenance fee |

A flat fee is charged by Raiz as follows:

Standard Portfolio A monthly Maintenance Fee of $3.50 is payable for six of the standard portfolios if your Raiz Investment Account has a value of less than the $15,000 threshold at the end of each month. If your balance is equal to or greater than $15,000, there is no Maintenance Fee.

Sapphire Portfolio The monthly Maintenance Fee is $3.50 for the Sapphire Portfolio (irrespective of your Account balance).

Property Portfolio The monthly Maintenance Fee is $4.50 for the Property Portfolio (irrespective of your Account balance).

Custom Portfolio The monthly Maintenance Fee of $4.50 is payable for the Custom Portfolio if your Raiz Investment Account has a value of less than $20,000 at the end of each month. If your Account has a value of equal to or greater than $20,000, there is no Maintenance Fee.

Raiz Kids

An additional monthly Maintenance Fee of $2.00 is payable for using Raiz Kids if the combined balances of the Raiz Kids accounts have a value of less than $8,750 at the end of each month, irrespective of whether you’ve set up 1 Raiz Kid Account or 8. If the combined balances of the Raiz Kids accounts has a value of equal to or greater than $8,750, there is no additional Maintenance Fee.

Note: All the above Maintenance Fees cover the cost of administering your Raiz Investment Account. They will be direct debited from your Funding Account, not your Raiz Investment Account. This means that the Maintenance Fee will not affect the balance of your Raiz Investment Account |

Account fees |

Raiz can also charge fees and costs for managing your investment. Standard Portfolio $0.00 p.a. (account balance of less than $15,000); or 0.275% p.a. (account balance equal to or greater than $15,000) Sapphire Portfolio 0.275% p.a. on all account balances Property Portfolio 0.275% p.a. on all account balances Custom Portfolio $0.00 p.a. (account balance of less than $20,000); or

0.275% p.a. (account balance equal to or greater than $20,000) Raiz Kids $0.00 p.a. (combined Raiz Kids account balance of less than $8,750); or

0.275% p.a. (combined Raiz Kids account balance equal to or greater than $8,750)

The fees with worked examples are disclosed below in the Fee and other costs section. |

Automatic rebalancing |

Raiz automatically rebalances your Raiz Investment Account:

that cause your Raiz Investment Account allocation to deviate by 5% or more from your Selected Portfolio target allocation. This keeps your Raiz Investment Account in line with the target allocation of your Selected Portfolio. We don’t charge any fees for rebalancing and no brokerage fees are payable (see Transaction Costs in section 5 for an explanation of applicable buy/sell spreads). |

Referral fees |

The Promoter and Administrator may from time to time determine to pay investors a referral fee, where that investor successfully refers another investor to open a Raiz Investment Account (Referral Fee). A Referral Fee will be payable if:

Both Investor A and Investor B will receive a Referral Fee in respect of an Effective Referral. The Website and App at any given time will specify whether a Referral Fee is currently payable, and the amount of any such Referral Fee. Investors will also be notified when a Referral Fee is currently payable |

when you contribute money;

when you withdraw money;

after a distribution has been paid; or

after fluctuations in the markets,

an investor who holds an active Raiz Investment Account with a balance of $5 or more (Investor A) refers another person (Investor B) to open a Raiz Investment Account; and

Investor B opens a Raiz Investment Account and deposits at least $5; and

the Terms of Use at the time of the referral specify that a Referral Fee is currently payable, (an Effective Referral).

through the App. Investors who make an Effective Referral will have the amount of any Referral Fee paid into their Raiz Investment Account within 7 business days. Referral Fees will be paid by the Promoter and Administrator personally.

Other risks

All investments involve risks—Investment values go up and down and income fluctuates. Different investment strategies carry different levels of risk. Investments with the highest long-term returns may also carry the highest level of short-term risk. You should consider the risks below and the risks included in the PDS when deciding whether to invest in a Raiz Investment Account and which Investments to choose. You should consider these risks against your own circumstances - which will vary depending on various factors, including age, investment time frame, expectations of returns, other investments held and tolerance to risk. |

Administration risk |

There may be delays in implementing your Investment Instructions. |

Inflation risk |

Investment returns may not be higher than inflation to enable you to reach your financial goals. |

Legal risk | Laws (including tax laws) can change or become difficult to enforce—particularly in emerging markets or related to Bitcoin. This can affect the value of Investments. Laws affecting managed investment schemes may change in the future. |

Custody risk | There is a risk that the Fund may incur a loss arising from the failure of a custodian to meet its obligations, including its obligation to provide for the safe custody of the assets of the Fund. |

Cyber security custodian risk in relation to Bitcoin |

Raiz will aim to hold at least 95% of the Bitcoin holding, held by the Gemini Custodian, in Cold Storage. The Bitcoin held in Cold Storage is stored on a platform that is not connected to the internet, thereby, protecting the Bitcoin from unauthorized access, cyber hacks, and other vulnerabilities that a system connected to the internet is susceptible to. Up to 5% of the Bitcoin will be stored in the custody account linked to the Gemini Exchange which is online. Therefore, this portion of the holding is more susceptible to cyber risks than the Bitcoin held in Cold Storage, as well as custody risk in relation to Gemini Exchange. |

Operational risks |

Operational risk includes those risks which ordinarily arise in the course of carrying on the funds management business. The processes, procedures and systems that are relied upon by the Responsible Entity, Custodian and Promoter and Administrator are sophisticated, and inadequacies within these processes, procedures and systems or the people operating them could lead to a problem with the operation of the Fund. The reinvestment of dividends, standing instructions (including rebalances) and instructions to deposit or withdraw cash occur only on a Business Day when the ASX market is open for ETFs or when the Gemini Exchange is trading Bitcoin. They may only occur once a day. If, for any reason, the market which the ETFs are quoted on, or the mechanism by which the underlying investments (including Bitcoin) are priced, or any part of it, is suspended or illiquid we will hold over your instructions (and any cash for investment) until the market, the relevant pricing mechanism or any part of it, re-opens or becomes liquid again. |

Bitcoin rebalance risks |

As mentioned in section 2, Raiz automatically rebalances your Raiz Investment Account when you contribute or withdraw money, after a distribution has been paid or after fluctuations in the market occur, that cause your Raiz Investment Account allocation to deviate by 5% or more from your Selected Portfolio target allocation.

If the price of Bitcoin is falling, the rebalance algorithm will keep buying Bitcoin as its price falls until the Sapphire Portfolio is rebalanced back to the 5% target asset allocation, thereby increasing possible losses if Bitcoin is consistently falling. See section on rebalancing in this AID. In addition to depositing and withdrawing money from your Raiz Investment Account, some examples where a rebalancing can be triggered include: a) increasing Bitcoin prices resulting in Bitcoin representing 10% of the overall allocation (up from a 5% target asset allocation); |

|

Every time a rebalance is triggered, the exposure to Bitcoin will be brought back to the target weight of 5% of the Sapphire Portfolio. For example, ETFs will be sold because of a fall in Bitcoin. If Bitcoin is continuing to fall regularly, the rebalancing process will repeat every time a rebalance is triggered.

If Bitcoin is rising, Bitcoin will be sold to bring back the Bitcoin holding to the target weight of 5% and the consideration from this sale will be invested into buying ETFs. This may reduce the potential gains possible if there was no rebalancing.

Although rebalancing risks apply to all Portfolios generally, it is particularly relevant to the Sapphire Portfolio due to the large price moves of Bitcoin. |

Bitcoin volatility and bubble risk |

Bitcoin is subject to high price volatility and has historically shown signs of a pricing bubble, a significant, sustainable rise above the reasonable value of Bitcoin. Also if you invest in the Sapphire Portfolio or hold Bitcoin in a Custom Portfolio, there is the possibility that sometime in the future Bitcoin may have no value. |

Other Bitcoin risks |

Bitcoin remains relatively unregulated under markets and securities laws globally. Much of the information made available to the market about Bitcoin in many cases is by non-regulated organisations, incomplete, difficult to understand, does not properly disclose the risks associated with investing in Bitcoin and therefore may be highly misleading to consumers about the risks in investing in Bitcoin.

Raiz, however, trades and uses an exchange and custodian regulated by the New York State Department of Financial Services.

The price formation of Bitcoin is often not transparent, and it can trade at different prices on different exchanges. There is therefore a risk that Raiz will not receive the same price for Bitcoin when buying or selling that are reported on other exchanges that trade in Bitcoin. In addition, Bitcoin mainly trades in US dollars and thus there is risk associated with fluctuations in the Australian-US dollar foreign exchange rate.

There is also the risk that operational problems may occur, such as trading disruptions of the Gemini Exchange. During these disruptions, we may not be able to buy or sell Bitcoin which may cause a loss due to price fluctuation of Bitcoin during the period of disruption.

Bitcoin presents many risks that are not associated with assets that trade on regulated exchanges such as shares, bonds and ETFs, and for this reason should be considered a very high risk investment. |

fluctuation of the price of one or more of the other ETFs in the Sapphire Portfolio and a falling Bitcoin price causing Bitcoin to represent practically 0% of the overall allocation (down from a 5% target asset allocation); and

fluctuation of the price of one or more of the other ETFs and Bitcoin in the Sapphire Portfolio causing Bitcoin to represent 10% of the overall allocation (up from a 5% target asset allocation).

Raiz Property Fund (RPF) risks | Key risks specific to an indirect investment in the Raiz Property Fund (RPF) include:

Portfolio risk

The assets of the RPF may be affected by several factors, including overall economic conditions and property market conditions.

Property valuation risk

The value of each property held by the RPF may fluctuate due to a number of factors affecting both the property market generally or RPF’s properties in particular. A reduction in the value of any property may adversely affect the value of Units.

Property illiquidity

By their nature, investments in real property assets are illiquid investments. There is a risk that should RPF be required to realise property assets, it may not be able to do so in a short period of time, or may not be able to realise a property asset for the amount at which it has been valued. This may adversely affect RPF’s NTA and the value of RPF Units.

Redemption Risk

The responsible entity of the RPF will endeavour to redeem RPF Units daily so that you can withdraw on a daily basis from your Raiz Investment Account, if you choose. The responsible entity will endeavour to effect payment of any withdrawals within 5 Business Days of receiving the redemption request. However, this timeframe is not guaranteed, and under the constitution, the RPF responsible entity has up to 180 days to redeem RPF Units. This may happen from time to time depending upon the liquidity of the RPF assets.

Gearing

RPF may borrow to acquire direct property assets. RPF may also invest in the Raiz Residential Property Fund which may already be geared. Gearing on a look-through basis will not exceed 50%. Gearing can affect the value and return on RPF Units.

Re-leasing and vacancy risk

Leases will be due for renewal on a periodic basis. There is a risk that the RPF may not be able to negotiate suitable lease renewals with existing tenants, maintain existing lease terms or locate new tenants to occupy any unoccupied properties. The RPF’s ability to secure lease renewals or to obtain new tenants may be influenced by the supply of properties in the market, which, in turn, may increase the time required to let vacant space. Should the RPF be unable to secure a tenant for a vacant property for a period of time, this will result in lower rental returns to RPF, which could materially adversely affect the RPF’s financial performance and distributions.

The RPF could lose tenants due to a range of events including as a result of failure to renew a lease, termination of a lease due to change of control, deterioration in the level of service provided to tenants, weakening of tenant relationships or disputes with tenants, consolidation of a tenant’s sites or insolvency of tenants. Any of these factors could adversely affect the financial performance of the Fund and distributions.

Property maintenance risk

There is a risk of physical damage to the property assets of the Fund. Physical damage may be caused by natural disasters, fire, damage by tenants or unforeseen structural issues. For example, a building may have concrete cancer or be subject to water damage as a result of flooding. The costs associated with repairing or remediating physical damage can be significant and may impact the financial performance of the Fund.

The property assets of the Fund will require ongoing maintenance, which may be costly.

Please refer to the Product Disclosure Statement for the Raiz Property Fund available here. The RPF PDS is incorporated by reference into this Additional Information Document. |

Investments

Investment Instructions

You must direct us to invest your Raiz Investment Account in a mix of the following ASX quoted ETFs and/or Gemini Exchange quoted Bitcoin and/or units in the RPF in accordance with your Selected Portfolio. Before deciding on your Selected Portfolio, you should consider the likely investment returns, the risks of investing, how much you can afford to invest on a regular basis, and the investment timeframe to determine if Raiz and a Selected Portfolio is suitable for you.

Asset Classes |

Asset Class |

ETF |

More information about the ETF or Bitcoin or RPF |

Australian large cap stocks |

SPDR S&P/ASX 200 ETF (STW.AU) |

The SPDR S&P/ASX 200 ETF (STW) is an exchange traded fund issued by State Street Global Advisers, Australia Services Limited. STW seeks to track the investment results of the S&P/ASX 200 index, which comprises 200 of the largest securities by market capitalisation and liquidity listed on the ASX. STW invests in a portfolio of equities which generally corresponds to the composition of the S&P/ASX 200 index. There is no guarantee that the returns of STW will meet its objective. The return of capital and the performance of STW cannot be guaranteed. For more information on STW, please refer to: https://www.spdrs.com.au/etf/fund/fund_detail_STW.html* |

Asian large cap stocks |

iShares Asia 50 ETF (IAA.AU) | The iShares Asia 50 ETF (IAA) is an exchange traded fund issued by BlackRock Investment Management (Australia) Limited. IAA seeks to track the investment results of the S&P Asia 50 index, which is a total float-adjusted, market capitalisation-weighted index that is designed to measure the performance of the leading 50 companies in six Asian countries, namely Taiwan, Hong Kong, China, Macau, South Korea and Singapore. IAA invests in a portfolio of equities which generally corresponds to the composition of the S&P Asia 50 index. There is no guarantee that the returns of IAA will meet its objective. The return of capital and the performance of IAA cannot be guaranteed. For more information on the IAA ETF, please refer to: https://www.blackrock.com/au/individual/products/273416/ishares-asia- 50-etf * |

European large cap stocks |

iShares Europe ETF (IEU.AU) |

The iShares Europe ETF (IEU) is an exchange traded fund issued by BlackRock Investment Management (Australia) Limited. IEU seeks to track the investment results of the S&P Europe 350 index, which measures the performance of the stocks of leading companies in the following European countries: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom. The S&P Europe 350 index may include large, mid or small-capitalisation companies. IEU invests in a portfolio of equities which generally corresponds to the composition of the S&P Europe 350 index. There is no guarantee that the returns of IEU will meet its objective. The return of capital and the performance of IEU cannot be guaranteed. For more information on IEU, please refer to: https://www.blackrock.com/au/individual/products/273427/ishares-europe- etf * |

US large cap stocks |

iShares Core S&P 500 ETF (IVV.AU) |

The iShares Core S&P 500 ETF (IVV) is an exchange traded fund issued by BlackRock Investment Management (Australia) Limited. IVV seeks to track the investment results of the S&P 500 index, which measures the performance of the large-capitalisation sector of the US equity market. IVV invests in a portfolio of equities which generally corresponds to the composition of the S&P 500. There is no guarantee that the returns of IVV will meet its objective. The return of capital and the performance of IVV cannot be guaranteed. For more information on IVV, please refer to: https://www.blackrock.com/au/individual/products/275304/ishares-ishares- core-s-and-p-500-etf * |

Australian large cap responsible investment stocks |

Russell Investments Australian Responsible Investment ETF (RARI.AU) | The Russell Investments Australian Responsible Investment ETF (RARI) seeks to track the Russell Australia ESG High Dividend Index, which is weighted towards companies that demonstrate positive environmental, social and governance characteristics after negatively screening for companies that have significant involvement in a range of activities deemed inconsistent with widely recognised responsible investment |

|

|

| considerations. RARI invests in Australian shares and trusts listed on the ASX. https://russellinvestments.com/au/funds/exchange-traded-funds/RARIETF * |

Global large cap sustainability leaders stocks |

BetaShares Global Sustainability Leaders ETF (ETHI.AU) | The BetaShares Global Sustainability Leaders ETF (ETHI) holds stocks identified as “Climate Leaders” that have passed eligibility screens designed to exclude companies with direct or significant exposure to the fossil fuel industry or engaged in other activities deemed inconsistent with responsible investment considerations. Climate Leaders are selected based on relative carbon efficiency. Additional eligibility screens are applied to remove companies with material exposure to: gambling, tobacco, armaments, uranium/nuclear energy, destruction of valuable environments, animal cruelty, chemicals of concern, mandatory detention of asylum seekers, alcohol, junk foods, pornography, recent significant fines/convictions, human rights & supply chain concerns. http://www.betashares.com.au/fund/global-sustainability-leaders-etf * |

Australian government bonds (fixed income) |

iShares Core Composite Bond ETF (IAF.AU) | The iShares Core Composite Bond ETF (IAF) is an exchange traded fund issued by BlackRock Investment Management (Australia) Limited. IAF aims to provide investors with the performance of an index, before fees and expenses, composed of investment grade fixed income bonds issued in the Australian debt market. IAF seeks to achieve this objective by tracing the performance of the Bloomberg AusBond Composite 0+ Yr index by investing in fixed income securities that as far as possible and practicable consist of the component securities of the index. The index includes investment grade fixed income securities issued by the Australian Treasury, Australian semi-government entities, supranational and sovereign entities and corporate entities. There is no guarantee that the returns of IAF will meet its objective. The return of capital and the performance of the fund cannot be guaranteed. For more information on IAF, please refer to: https://www.blackrock.com/au/individual/products/251977/ishares- composite-bond-etf* |

Australian corporate bonds (fixed income) |

Russell Australian Select Corporate Bond ETF (RCB.AU) | The Russell Australian Select Corporate Bond ETF (RCB) is an exchange traded fund issued by Russell Investment Management Limited. RCB aims to provide investors with a total return, before costs and tax, in line with the DBIQ 0-3 year Investment Grade Australian Corporate Bond Index over the long term. RCB seeks to achieve this objective by tracking the performance of the DBIQ 0-3 year Investment Grade Australian Corporate Bond Index by investing predominantly in Australian corporate fixed income securities. There is no guarantee that the returns of RCB will meet its objective. The return of capital and the performance of RCB cannot be guaranteed. For more information on RCB, please refer to: https://russellinvestments.com/au/funds/exchange-traded- funds/RASCBETF * |

Australian money market (cash) |

BetaShares Australia High Interest Cash ETF (AAA.AU) | The BetaShares Australia High Interest Cash ETF (AAA) is an exchange traded fund issued by BetaShares Capital Limited. AAA aims to provide attractive, regular income distributions and a high level of capital security. AAA aims to provide investors with a return that exceeds the 30 day Bank Bill Swap Rate, after fees and expenses. AAA invests all of its assets into bank deposit accounts maintained with one or more of the four major banks in Australia (ANZ, CBA, NAB and Westpac). There is no guarantee that the returns of AAA will meet its objective. The return of capital and the performance of AAA cannot be guaranteed. For more information on AAA, please refer to: http://www.betashares.com.au/products/name/australian-high-interest- cash-etf/* |

US large cap stocks listed on the NASDAQ exchange |

BetaShares Nasdaq 100 ETF (NDQ.AU) | The BetaShares Nasdaq 100 ETF (NDQ) is an exchange traded fund issued by BetaShares Capital Limited. NDQ aims to track the performance of the NASDAQ-100 Index. The NASDAQ-100 comprises 100 of the largest non-financial companies listed on the NASDAQ market, and includes many companies that are at the forefront of the new economy. There is no guarantee that the returns of NDQ will meet its objective. The return of capital and the performance of NDQ cannot be guaranteed. For more information on NDQ, please refer to: https://www.betashares.com.au/fund/nasdaq-100-etf/ * |

|

Global large cap stocks |

iShares Global 100 ETF (IOO.AU) | The iShares Global 100 ETF (IOO) is an exchange traded fund issued by BlackRock Investment Management (Australia) Limited. The IOO aims to provide investors with the performance of the S&P Global 100TM Index. The index is designed to measure the performance of 100 multi-national, blue chip companies of major importance in global equity markets. There is no guarantee that the returns of IOO will meet its objective. The return of capital and the performance of the fund cannot be guaranteed. For more information on IOO, please refer to: https://www.blackrock.com/au/individual/products/273428/ishares-global- 100-etf* |

Emerging market large cap stocks |

Vanguard FTSE Emerging Markets Shares ETF (VGE.AU) | The Vanguard FTSE Emerging Markets Shares ETF (VGE) is an exchange traded fund issued by Vanguard Investments Australia Limited. The VGE seeks to track the return of the FTSE Emerging Markets All Cap China A Inclusion Index (with net dividends reinvested) in Australian dollars. There is no guarantee that the returns of VGE will meet its objective. The return of capital and the performance of the fund cannot be guaranteed. For more information on VGE, please refer to: https://www.vanguard.com.au/personal/products/en/detail/8204/Overview* |

Global healthcare |

iShares Global Healthcare ETF (IXJ.AU) | The iShares Global Healthcare ETF (IXJ) is an exchange traded fund issued by BlackRock Investment Management (Australia) Limited. The IXJ aims to provide investors with the performance of the S&P Global 1200 Healthcare Sector Index. The index is designed to measure the performance of global biotechnology, healthcare, medical equipment, and pharmaceuticals companies and may include large-, mid- or small- capitalisation stocks. There is no guarantee that the returns of IXJ will meet its objective. The return of capital and the performance of the fund cannot be guaranteed. For more information on IXJ, please refer to: https://www.blackrock.com/au/individual/products/273430/ishares-global- healthcare-etf* |

Australian sustainability leaders |

BetaShares Australian Sustainability Leaders ETF (FAIR.AU) | The BetaShares Australian Sustainability Leaders ETF (FAIR) is an exchange traded fund issued by BetaShares Capital Limited. FAIR aims to track the performance of an index that includes Australian companies that have passed screens to exclude companies with direct or significant exposure to fossil fuels or engaged in activities deemed inconsistent with responsible investment considerations. FAIR’s methodology also preferences companies classified as “Sustainability Leaders” based on their involvement in sustainable business activities. There is no guarantee that the returns of FAIR will meet its objective. The return of capital and the performance of FAIR cannot be guaranteed. For more information on FAIR, please refer to: https://www.betashares.com.au/fund/australian-sustainability-leaders-etf/ * |

Australian small cap |

Vanguard MSCI Australian Small Companies Index ETF (VSO) | The Vanguard MSCI Australian Small Companies Index ETF (VSO) is an exchange traded fund issued by Vanguard Investments Australia Limited. The VSO seeks to track the return of the MSCI Australian Small Companies Index before taking into account fees, expenses and taxes. There is no guarantee that the returns of VSO will meet its objective. The return of capital and the performance of the fund cannot be guaranteed. For more information on VSO, please refer to: https://www.vanguard.com.au/personal/products/en/detail/8211/Overview* |

Ethically conscious global bonds (hedged) |

Vanguard Ethically Conscious Global Aggregate Bond Index Hedged ETF (VEFI) | Vanguard Ethically Conscious Global Aggregate Bond Index Hedged ETF (VEFI) is an exchange traded fund issued by Vanguard Investment Australia Limited. The VEFI track the return of the Bloomberg Barclays MSCI Global Aggregate SRI Exclusions Float Adjusted Index Hedged into Australian dollars before taking into account fees, expenses and tax. There is no guarantee that the returns of VEFI will meet its objective. The return of capital and the performance of the fund cannot be guaranteed. For more information on VEFI, please refer to: https://www.vanguard.com.au/personal/products/en/detail/8224/Overview* |

Australian corporate bonds |

Vanguard Australian Corporate Fixed Interest Index ETF (VACF.AU) | Vanguard Australian Corporate Fixed Interest Index ETF is an exchange- traded fund incorporated in Australia. The Fund seeks to track the performance of the Bloomberg AusBond Credit 0+ Year Index before taking into account fees, expenses and tax. For more information on VACF, please refer to: |

|

|

| https://www.vanguard.com.au/adviser/products/en/detail/etf/8203/bond * |

Australian ethically conscious stocks |